I. Introduction

Since the emergence of the COVID-19 pandemic in China and its announcement, it has not been difficult to predict that its economic repercussions would be very large and influential, not only because of China’s global economic position, but also because of the suddenness of the virus’ rapid spread. These factors prompted all countries to take a series of decisions and measures aimed at avoiding the deadly scourge of the virus as much as possible. Moreover, the negative effects on companies Abegan to appear, due to the cancellation of entertainment and economic activities around the world, and a number of companies decided to freeze employment and provide voluntary unpaid leave (Ibn-Mohammed et al., 2021). There is no doubt that we are all living in conditions of a global crisis called coronavirus (COVID-19), and some researchers see it as devastating the global economy (Leach et al., 2021).

The unexpected emergence and accelerating expansion of COVID-19 have created an environment of uncertainty in the world’s economic factors and pushed the current global uncertainty toward a dangerous edge with severe consequences (Caduff, 2020). Various authors have documented that uncertainty regarding social, political, or economic conditions considerably influences investor sentiment (Beugelsdijk & Frijns, 2010; Shiller, 2005; Shu & Chang, 2015), and should therefore be reflected in the behavior of investment assets.

In the beginning of 2020, to protect the health of the public, factories ceased production and people’s freedom of movement was severely restricted. Also, companies have reported an increase in downside risks (Barrero & Bloom, 2020). In addition, the global economic policy uncertainty index (EPU) peaked in May 2020 at 520, compared to its lowest value in July 2007 during the financial crisis. Empirical research by economists also shows that the huge impact of uncertainty caused by the COVID-19 pandemic outbreak is greater than that during the 2008 global financial crisis, and its degree is similar to that of the uncertainty that increased during the Great Depression of 1929–1933 and the crisis of the Spanish flu pandemic of 1918–1919 (Leach et al., 2021; Sher, 2020).

Aimer (2021) examined the effect of EPU on exchange rates in the countries that recorded the highest numbers of COVID-19 deaths. The results indicate that, during the pandemic period, there has been a positive relation between EPU and exchange rates. Fetzer et al. (2020) argued that the spread of the new COVID-19 has greatly disrupted the economies of countries through slowing production, which has led many economic politicians to express their concerns about expectations of a recession. Albulescu (2020), on the other hand, examined the impact of the new COVID-19 on EPU for the period from January to March 2020 and found that the global rate of new infections and deaths due to the pandemic had no significant impact on the EPU. However, when analyzing the situation in other countries outside China, Albulescu discovered that the numbers of new cases and deaths due to COVID-19 have had a positive effect on EPU. Jeris and Nath (2020) found that the number of cases and deaths due to COVID-19 have had a statistically significant positive effect on EPU in the long term. Furthermore, Geyikci (2021), using the autoregressive distributed lag approach, examined the effects of COVID-19 (as a proxy for the numbers of new cases and deaths) and crude oil prices on EPU for Turkey. The author found that the pandemic has had a positive and statistically significant effect on EPU in the long run, while crude oil prices have had a negative impact on EPU in the long term.

We conclude from the above-mentioned studies that the literature on the effects of COVID-19 on EPU is very scant and has not considered symmetric and asymmetric effects. Our research contributes to the literature by demonstrating the positive and negative shock effects of the COVID-19 pandemic on US EPU. Our study differs from previous literature in that our analysis focuses on the symmetric and asymmetric effects of the COVID-19 epidemic on the EPU developed by Baker et al. (2016). To our knowledge, this is the first paper to address the asymmetric effects of the COVID-19 crisis on the Economic Policy Uncertainty Index for the Unite States (EPU). We bridge this gap and test the asymmetric impact of the COVID-19 shock on EPU by using the nonlinear autoregressive distributed lag (NARDL) approach, helping cast new light on corresponding research that merely considers the symmetric effect.

The remainder of this paper is organized as follows. Section 2 presents the data and methodology. Section 3 illustrates the experimental results. Section 4 concludes the paper and discusses policy implications.

II. Data and Methodology

A. Data and Variables

We examine the impact of the COVID-19 pandemic, by using the number of confirmed COVID-19 cases per day as a proxy, on the EPU Index for the United States during the daily period from February 26, 2020, when the community spread of COVID-19 cases was first reported in the United States, to November 30, 2020. We express our main variables as follows:

EPUt=lnEPUt−lnEPUt−1COVIDt=lnCOVIDt−lnCOVIDt−1

We use the EPU index of Baker et al. (2016) for the United States, which reflects the frequency of articles with the keywords economic, policy, and uncertainty in about 2,000 US newspapers. The EPU was collected from the Federal Reserve Economic Data database,[1] while the numbers of new cases due to COVID-19 are from Our World in Data database.[2]

B. Model Specifications

We consider the long-term asymmetric regressions of Pesaran et al. (2001), as shown in the following equation:

EPUt =α+COVID+t+α−COVID−t+εt

where and are the associated long-term asymmetric parameters.

Shin et al. (2014) shows that the NARDL model integrates asymmetry in long- and short-term relations and can capture asymmetry through dynamic adjustment. In addition, the model has the advantage of including stable time series variables and unstable variables. To address the asymmetric effect, the model in Equation (2) can be modified so that the vector of the COVID-19 variable is decomposed into a positive and negative partial sum, as shown in the following:

COVID−t=t∑J=1D(COVID)−j=t∑j=1min(D(COVID)j,0)COVID+t=t∑J=1D(COVID)+j=t∑j=1max(D(COVID)j,0)

The short- and long-run asymmetry of the COVID-19 impact on EPU can be described as follows:

D(EPU)t=α0+n1∑i=1α1iD(EPU)t−i+n2∑i=0α2iΔ(COVID)t−i+n3∑i=0α+3iD(COVID)+t−i+n4∑i=0α−4iD(COVID)−t−i+β0ln(EPU)t−1+β1ln(COVID)t−1+β+2COVID+t−1+β−2COVID−t−1+ξt

where and are the long-run coefficients of the negative and positive shocks of COVID-19, respectively. The negative and positive superscripts stand for the partial sums of positive and negative shocks of COVID-19, and are the short-run coefficients of the positive and negative shocks of COVID-19, respectively.

Finally, the asymmetric cumulative dynamic multiplier effects of the unit change in and on are as follows:

m−h=h∑j=0∂yt+j∂COVID−tm+h=h∑j=0∂yt+j∂COVID+t

where and

III. Results and Discussion

A. Unit Root Test

Before estimating our model, knowledge of the stationarity properties of the variables is required. Therefore, we use the augmented Dickey–Fuller (ADF) and Phillips–Peron (PP) unit root tests (see Table 1).

The results of Table 1 indicate that the variables are integrated of order I(0) or I(1). Since none of the variables are of order I(2), we can apply the NARDL model without hesitation.

B. Estimation of the Cointegration Relation (NARDL Model)

Based on the study of Pesaran and Shin (1998), to find the long-range relation, we use the NARDL cointegration bounds test methodology. Table 2 shows the bounds test results for nonlinear cointegration (F-statistics).

Table 2 shows that, in the case of the short term, a positive or negative shock of COVID-19 has no statistically significant effect on the EPU. This finding supports the results of Jeris and Nath (2020), who also found no short-term effect. On the other hand, we find the long-term coefficients of the positive and negative shocks of COVID-19 to be positive. Consequently, the increase in COVID-19 cases has a direct positive impact on EPU. This result also supports the findings of Albulescu (2020) and Jeris and Nath (2020), who found a long-run association between new COVID-19 cases and the EPU.

C. Asymmetry Test Results

We subsequently apply Wald’s test to test for asymmetry relationship between EPU and COVID-19 in the short and long run. Table 3 shows the results of the Wald test for the null hypothesis of short- and long-term symmetry versus the asymmetry surrogate between EPU and COVID-19.

Wald’s test results in Table 3 show that, in the short- and long-term cases, COVID-19 shocks have a symmetric effect on EPU. Therefore, (the number of cases of) COVID-19 affects the EPU significantly and symmetrically. More specifically, a 1% increase (decrease) in the number of COVID-19 cases leads to a 0.36% increase (decrease) in EPU.

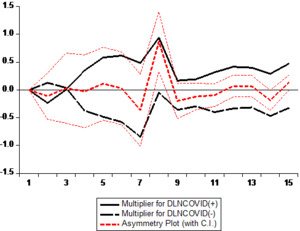

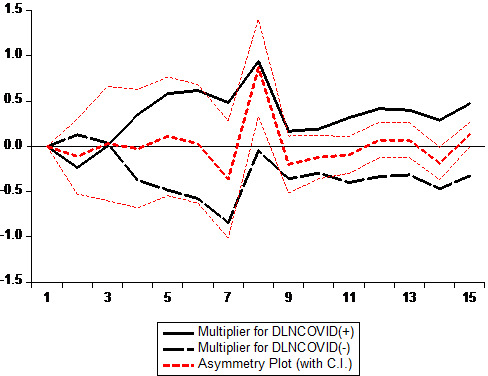

D. Dynamic Nonlinear Multiplier Results

Figure 1 presents the dynamic effects of COVID-19’s positive and negative differences on EPU. Based on Figure 1, an asymmetric response to EPU to positive and negative differences of the number of confirmed COVID-19 cases per day.

The empirical results above have important insinuations for investors, as well as analysts and policymakers. First, we note that the impact of positive and negative variations in the number of confirmed cases affects EPU. Second, we demonstrate that EPU is very sensitive to the positive and negative shocks of COVID-19.

E. Diagnostic Tests

To ensure the robustness of the model, we first judge the adequacy of the dynamic specifications. We do so according to various diagnostic statistics, including Lagrange multiplier statistics and (autoregressive conditional) heteroscedasticity tests, as shown in Table 3.

According to the results, our model passes all the diagnostic tests, revealing no autocorrelation and heterogeneity. However, according to the Jarque–Bera statistics, the regression estimate follows a normal distribution. To check the robustness of any statistical exploration, we check parameter stationarity using the CUSUM or CUSUMQ test. The results show parameter stationarity, that is, no violation of the standard assumptions of the regression, indicating that the model is stable. In other words, the relation between the variables as characterized by the NARDL model is not time varying.

IV. Conclusions

In this paper, we examine the asymmetric impact of the dynamics of the COVID-19 pandemic (number of cases) on EPU covering the period between February 26, 2020, and November 30, 2020, using the NARDL approach. This paper is one of a handful of pioneering studies examining the relation between EPU and the COVID-19 pandemic, which emerged in late 2019 and has been strongly felt around the world since April 2020. According to the results of the bounds test, new cases of the epidemic have a long-term impact on EPU. In addition, the epidemic has no strong short-term impact on EPU.

In the case of symmetric and asymmetric effects, we find quite similar symmetric effects of the COVID-19 shock (positive and negative) on the EPU. Thus, a 1% increase/decrease in positive and negative shocks to COVID-19 is expected to increase/decrease the EPU by 37% in the long run. The asymmetry results, controlling for all other factors, reveal the serious impact of the COVID-19 pandemic on EPU for decision makers, indicating that the pandemic clearly increases the EPU. Thus, investors should therefore be very careful about their actions during the COVID-19 pandemic period.

We recommend expanding the study to a longer period and large dataset in the future, to contribute to a better understanding of the symmetric and asymmetric effects of the COVID-19 pandemic.

Acknowledgment

Helpful comments of the anonymous reviewers and the journal editor are acknowledged. No funding was received for this study.